Funding the Future of Water

- bluechain

- 11 hours ago

- 3 min read

What the UK’s White Paper Reveals About Sustainable Finance

The recent UK Government’s Water White Paper sets out a wide-ranging programme of reform, spanning governance, planning, environmental protection, customer outcomes, and regulatory structure. It is explicitly framed as a “once-in-a-generation” reset of the water system, with much of the operational detail still to follow through the forthcoming Transition Plan. This blog deliberately looks at the White Paper through a single lens: what it signals about the future financing of the water sector. Financing is only one strand among many, but it cuts across almost every reform area. For developing countries seeking to expand investment in water through private and blended finance mechanisms, the UK reforms offer useful points for reflection, not as a template to replicate, but as an example of how financing, regulation, and long-term planning can be deliberately aligned. Regulatory design, planning horizons, performance regimes, and investment incentives are tightly interlinked, and examining them together helps to clarify how governments can seek to balance long-term ambition with the practical realities of funding, affordability, and risk.

Investment scale and long-term certainty

The White Paper sits alongside the £104bn AMP8 investment programme and recognises that significant capital investment will continue to be required for decades. Rather than changing the five-year price control cycle, government proposes to embed it within longer 10-year and 25-year strategic horizons, supported by earlier and expanded Strategic Policy Statements. From a financing perspective, this matters because long-term clarity reduces uncertainty for investors and delivery partners, helping to smooth investment cycles and reduce avoidable cost escalation.

Changes to how investment is funded and recovered

Several proposed reforms directly affect how investment flows through the regulatory system:

The abolition of the Quality and Ambition Assessment, removing incentives for companies to under-state investment needs.

The planned end of the totex framework, with future price reviews separating operating expenditure, capital maintenance, and enhancement investment.

A review of asset depreciation rules, intended to better reflect asset value over time and allow efficient recovery of new investment.

Together, these changes suggest a shift toward a more transparent and asset-focused approach to funding infrastructure, supported by stronger technical capability within the regulator.

Financial resilience as a policy objective

The creation of a single integrated regulator is accompanied by explicit financial objectives, including strengthening company resilience and supporting the sector’s ability to attract long-term investment. Measures highlighted in the White Paper include:

New tools to prevent the build-up of unmanageable debt.

A duty on the regulator to support sector creditworthiness, helping to lower the cost of finance.

Requirements for companies to plan for Special Administration scenarios, reducing systemic risk.

These proposals indicate that financial health is being treated as a legitimate regulatory concern, rather than an incidental outcome of price controls.

Pricing, volatility, and affordability

On customer bills, the White Paper commits to smoother cost trajectories, avoiding sudden price shocks. Performance incentives are to be simplified to reduce volatility in returns, and the paper signals that companies should not face overlapping penalties for the same failure through different regulatory mechanisms. Viewed through a financing lens, these changes point toward more predictable cashflows and a closer alignment between investment delivery, performance, and customer impacts.

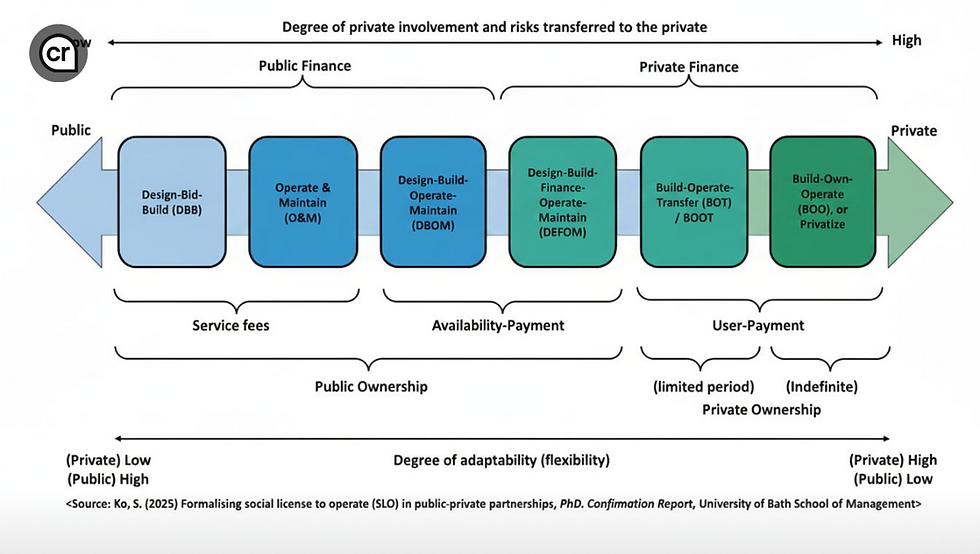

Investment instruments and ownership models

The White Paper also leaves open the possibility of evolving financing approaches. Government will explore whether green bonds could support additional investment, and the regulator will develop a transparent process for assessing proposals to move to alternative ownership models, including not-for-profit structures. While not prescriptive, this reflects an openness to diversifying how capital is mobilised, provided it supports long-term outcomes.

Reflections for developing countries pursuing private and blended finance

For developing countries seeking to expand investment in water through private and blended finance mechanisms, the UK reforms offer useful points for reflection, not as a model to copy, but as an illustration of underlying principles.

Financing cannot be separated from system design. Private and blended finance is most effective where regulatory frameworks, planning processes, and performance regimes are aligned and credible.

Long-term clarity reduces financing costs. Extended planning horizons and stable policy signals can lower risk premiums as effectively as financial guarantees or concessional capital.

Affordability and investment are not opposites. The UK approach highlights bill smoothing and targeted support as alternatives to chronic under-investment driven by tariff suppression.

Regulatory capability matters. Engineering-led oversight, asset health metrics, and supervisory regulation all strengthen the foundations on which private finance depends.

Finally, the composition of capital matters as much as its volume. Designing regimes that attract patient, long-term investors—while discouraging short-term extraction—is especially important where public trust in private participation is fragile.

Seen through a financing lens, the UK Water White Paper suggests that mobilising private and blended finance is less about financial innovation alone, and more about building institutions, incentives, and planning frameworks that make long-term investment both credible and affordable.

Comments