The Lobito Corridor and the New Contours of Development Finance

- bluechain

- Jan 19

- 3 min read

The financing of Angola’s Lobito Atlantic Railway is widely expected to deliver tangible economic and development benefits for the region. By rehabilitating a major transport corridor linking the Atlantic coast to the mineral-rich interior of Central Africa, the project has the potential to reduce logistics costs, improve market access, and support regional trade integration. For Angola, the Democratic Republic of Congo, and Zambia, the corridor offers an opportunity to strengthen export capacity, enhance competitiveness, and stimulate investment along a critical infrastructure backbone.

Supported by the U.S. International Development Finance Corporation (DFC), the Lobito project should be understood not as a singular national initiative, but as an example of a changing approach to development finance. It brings together strategic infrastructure, commercial viability, and development objectives within a single investment framework, illustrating how large-scale projects are increasingly structured to deliver both economic impact and financial sustainability.

At its core, the Lobito Corridor is intended to expand export capacity for copper, cobalt, and other critical minerals flowing to global markets. For development finance practitioners, its relevance lies not only in improved logistics, but in how it links infrastructure investment to supply-chain resilience, regional integration, and longer-term industrial competitiveness. In this context, development outcomes and economic considerations are increasingly interconnected.

While the DFC-financed Lobito project stands out for its scale and visibility, it appears consistent with a broader pattern across the development finance landscape. Recent activity by development finance institutions and multilateral partners has increasingly focused on infrastructure, critical minerals, food systems, energy security, and post-conflict reconstruction, sectors that combine traditional development objectives with wider economic relevance. Across regions, financing structures are being designed to mobilize private capital into projects that address market gaps while strengthening production and trade networks.

This evolving emphasis invites comparison with China’s long-standing infrastructure strategy under the Belt and Road Initiative. Like many Chinese-financed corridors, Lobito treats infrastructure as a foundational asset shaping trade routes, investment flows, and economic relationships. Both approaches reflect a shared recognition that ports, railways, and logistics systems are central to growth and to the integration of resource-rich regions into global value chains. In this sense, the Lobito Corridor aligns with a broader view that infrastructure can serve both developmental and economic coordination functions.

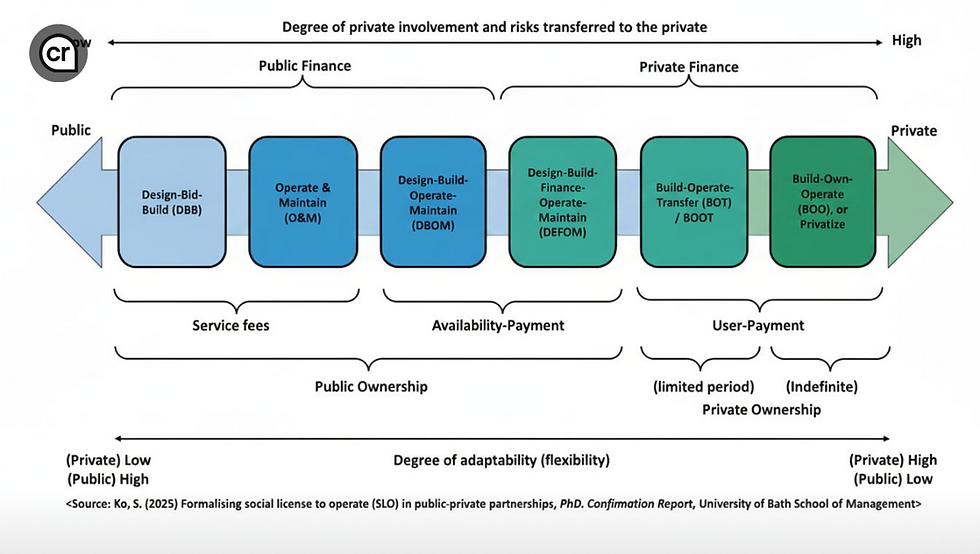

At the same time, differences in financing models remain important. China’s approach has historically been led by state policy banks and state-owned enterprises, often implemented through bilateral arrangements and at significant scale. Other development finance actors, including those supporting Lobito, place greater emphasis on market-oriented structures, private-sector participation, and defined financial, environmental, and governance standards. Where some models prioritise speed and scale, others focus on commercial sustainability, risk-sharing, and the ability to crowd in private investment alongside development outcomes.

This shift toward commercially oriented, “trade not aid” models also raises important questions for sectors where bankability remains limited, particularly water and sanitation. Unlike transport corridors or mineral-linked infrastructure, most water utilities in emerging markets lack cost recovery, face regulatory and political constraints on tariffs, and struggle with weak balance sheets. As a result, they are often unable to attract private investment on a standalone basis. For many observers, the Lobito-style model highlights both the potential and the limits of the current development finance trajectory: while strategic, revenue-generating infrastructure may increasingly mobilize private capital, essential services such as water are likely to continue requiring concessional finance, public investment, and long-term institutional support in the near term.

For African economies and the development finance community, the implications are therefore multifaceted. Greater diversity among external financing sources can expand access to capital and improve project structuring. Strategic corridors such as Lobito have the potential to reduce trade costs, strengthen regional value chains, and support industrial activity. At the same time, as infrastructure finance becomes more closely linked to supply-chain considerations and broader economic objectives, ensuring that non-commercial but socially critical sectors are not left behind remains an important challenge.

The DFC-financed Lobito Corridor should therefore not be viewed as a turning point in isolation, but as a useful reference point within a wider evolution in development finance practice. Across regions and institutions, the field is moving toward models in which investment discipline, market integration, and development objectives increasingly intersect. For practitioners, the ongoing task will be to balance this shift with continued support for sectors, such as water, where development impact is high but commercial viability remains constrained, ensuring that the benefits of this evolving approach are broadly shared.

Comments